Vision

To be the leading institute, nurturing banking professionals and building a strong, diverse pool of competent, ethical, and future-ready talent for Hong Kong and beyond.

Mission

To advance banking excellence by empowering professionals to become future-ready through training, certification, and collaboration.

About The Hong Kong Institute of Bankers (HKIB)

Established in 1963, The Hong Kong Institute of Bankers (HKIB) is the first not-for-profit organisation in Hong Kong dedicated to advancing banking excellence in the region. As a trusted learning and certification hub, HKIB is the only professional body in the city to offer banking professional qualifications comparable to a Master’s degree. HKIB serves as an advocate for capacity building and is committed to cultivating a competent, ethical, and future-ready workforce to strengthen Hong Kong’s advantages as an international financial centre. Through creating a common qualification benchmark, fostering knowledge exchange, promoting professional networking and enhancing talent development, HKIB supports local talent and the next generation of professionals, contributing to the long-term stability and effectiveness of the banking industry.

HKIB is committed to furthering the interests of the banking industry and its members by:

-

Enhancing Professionalism:

-

Setting and conducting rigorous professional examinations in banking and finance.

-

Administering industry-recognised professional qualifications and certificates, including the flagship Certified Banker programme, the Enhanced Competency Framework modules, and Continuing Development Activities.

-

Supporting Talent Development:

-

Providing high-quality training, learning resources, and scholarships to cultivate holistic bankers equipped with both theoretical and practical knowledge.

-

Creating a strong and diverse talent pool by nurturing the next generation of banking professionals.

-

Setting a Common Qualification Benchmark:

-

Strengthening the competency of banking professionals and promoting mutual recognition of qualifications both regionally and internationally.

-

Empowering individuals to advance their careers and contribute to capacity building within the industry through a comprehensive development pathway.

-

Facilitating Knowledge Exchange:

-

Harnessing technology to create diverse platforms — including conferences, seminars and luncheons, regulatory initiatives, awards, and networking events — that foster meaningful dialogue and share best practices within the banking industry to ensure its ongoing dynamism and competitiveness.

-

Contributing to Industry Stability:

-

Supporting collaborative initiatives that enhance the resilience and effectiveness of the banking industry, with a focus on attracting, nurturing, and retaining talent to build a robust banking community.

CEO Message

The year 2025 was one that called for bold innovation, driven by rapid shifts in industry demands, technological breakthroughs, and new business prospects, all emerging across the globe. In Hong Kong, it was also a year that reaffirmed the city’s resilience, agility, and unity.

Our city’s strength was reflected in its rise among the top three in the Global Financial Centres Index (GFCI), its re-emergence as the world’s top IPO market, and its leap to fourth place in the World Talent Ranking 2025. Initiatives such as “Fintech 2030”, a forward-looking strategy unveiled by the Hong Kong Monetary Authority (HKMA) at FinTech Week 2025, further underscored the city’s proactive vision. Against this backdrop, The Hong Kong Institute of Bankers (HKIB) remains steadfast in nurturing banking professionals and building a strong, diverse pool of competent, ethical, and future-ready talent through training, certification and collaboration.

Addressing the skills demands for the banking industry

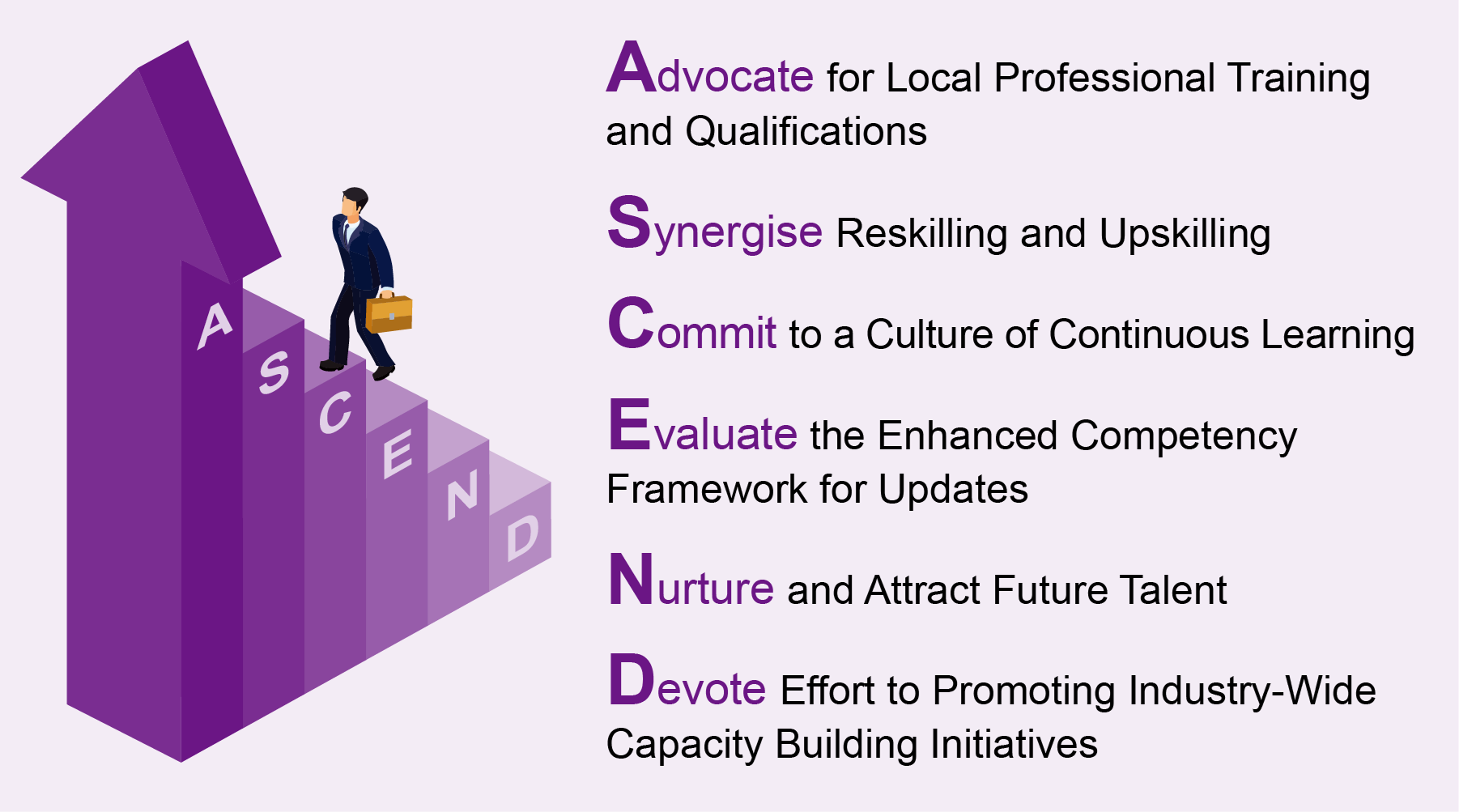

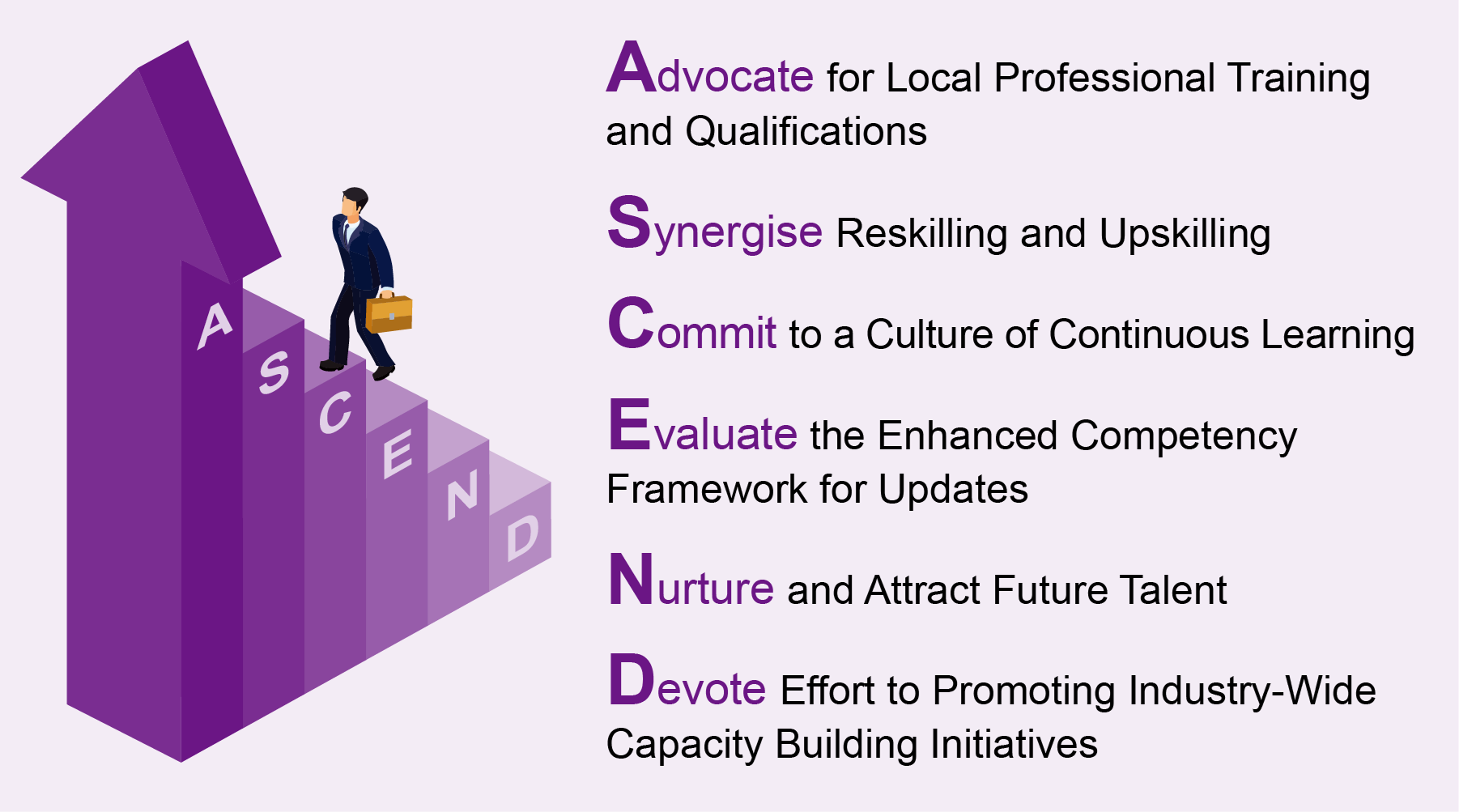

In August 2025, the HKMA, The Hong Kong Association of Banks (HKAB), and HKIB jointly published the “Capacity Building for Future Banking 2026-2030” study. This study identified three major skill demands, technological and data skills, soft skills, and banking knowledge. More importantly, the study established a structured and holistic approach, A.S.C.E.N.D. – advocate, synergise, commit, evaluate, nurture, and devote – to guide the banking industry’s transformation and long-term talent development in the years ahead. In support of this direction, HKIB has been working closely with industry stakeholders. For example, we collaborated on the inaugural tailor-made AI training course, organised by HKAB with support from the HKMA, which attracted over 3,000 enrolments from more than 110 banks.

Building on this framework, in 2026, HKIB will officially launch the ASCEND CPD Series, a forward-looking initiative offering targeted short courses aligned with the priorities outlined in the capacity building report. This series is designed to strengthen industry capabilities and support banking professionals in navigating an increasingly dynamic and complex financial landscape.

To further reinforce this talent development journey, HKIB will introduce the ASCEND Certificate in 2026, targeting banking professionals who are committed to continuous professional development and personal growth. This initiative supports professionals in staying up-to-date with the latest knowledge and invest in their career progression.

Providing professional qualification pathways for banking talent

As HKIB continued to grow, 2025 marked a defining chapter that signified both growth and renewed recognition. The Education Bureau reappointed HKIB as a Professional Qualifications Assessment Agency (PQAA), accredited under the Hong Kong Qualifications Framework (HKQF). HKIB is the only professional institution that offers professional qualifications up to Level 6 under the HKQF for the banking industry, which is equivalent to that of a Master’s degree, reaffirming its leadership in professional standards and assessment strategies.

Building on this renewed recognition, the penetration rate of our flagship Certified Banker (CB) programme across banks in Hong Kong saw a notable increase of 10%. As a key hub for professional training and certification, HKIB expanded its portfolio to 36 professional qualifications across eight streams, including the launch of the Enhanced Competency Framework on Green and Sustainable Finance (ECF-GSF) at the Professional Level. Additionally, HKIB introduced two new pathways, “CB Affiliate” and “ECF Affiliate”, to empower aspiring professionals with recognised opportunities for career progression.

With these foundations in place, we will streamline the eight ECF core levels into a single level, encouraging banking practitioners to develop multi-skills and strengthen their core competencies. Our next step in 2026 is to initiate the revamp of the ECF programme where needed. It will also further strengthen the CB programme as the benchmark professional qualification for the industry, ensuring alignment with the A.S.C.E.N.D. framework and the evolving skills landscape.

Fostering a strong community of banking professionals within Hong Kong and beyond

Recognition remains a powerful catalyst for building a strong and thriving professional community. In 2025, through initiatives such as the Hong Kong Banking Industry Talent Development Awards Programme, HKIB celebrated institutions that invest in their people and set benchmarks for excellence in talent development. This commitment to celebrating institutional excellence was complemented by individual recognition. For the fifth consecutive year, we conferred the prestigious “Honorary Certified Banker” title on distinguished industry leaders during our Annual Banking Conference, in recognition of their outstanding contributions to advancing professionalism and nurturing professional talent for the Hong Kong’s banking industry.

Beyond these recognition initiatives, 2025 also featured a notable highlight that brought the industry together. A highlight of 2025 was the Green Fintech Symposium co-hosted with the HKMA, which brought together leading experts to explore how Fintech, artificial intelligence, and data are reshaping the sustainable investment landscape. This signature event strengthened HKIB’s role in fostering cross-institutional dialogue, connecting professionals within Hong Kong's banking community and beyond.

Regionally, HKIB strengthened cross-boundary collaboration in the Guangdong-Hong Kong-Macao Greater Bay Area, co-hosting the second Macao Financial Talent Development Day with the Macau Institute of Financial Services (MIFS) in 2025. The event engaged over 250 financial practitioners and university students, fostering regional talent development. Furthermore, we expanded our reach by co-organising the Mainland Economic and Finance Elite Seminar with HKMA in Hangzhou for senior management, blending expert-led lectures with visits to pioneering technology enterprises to ignite strategic synergies.

To sustain this progress, HKIB will deepen its partnerships with key industry stakeholders such as MIFS and the China Banking Association (CBA) to cultivate cross-sector expertise, enhance banking talent mobility and advance mutual recognition of professional qualifications across the region.

Nurturing talent for today and tomorrow

At HKIB, we are committed to empowering the next generation of banking professionals through knowledge, engagement, and opportunity. Our CB Alumni community, launched in 2024 under the theme “CB Nurtures CB”, came to life in 2025 through initiatives such as the Top Bankers Sharing Series where industry leaders impart strategic insights, and three alumni stories showcasing how CB certification has elevated leadership capabilities within and beyond banking.

Leveraging this strong foundation, HKIB will introduce the CB Mentorship Programme in 2026, pairing CB holders with aspiring CB learners to offer guidance, support career development and strengthen professional networks across the industry.

Targeting future leaders, our ENLIGHTEN initiative adopts a holistic approach to support university students and early-career professionals, nurturing talent and enhancing industry readiness. In 2025, we advanced this agenda through 20 career talks and fairs, six modular exemption agreements with academic institutions, and nine university visits, engaging nearly 10,000 students.

To accelerate this momentum, in 2026, ENLIGHTEN with ASCEND will further expand HKIB’s presence through new partnerships, student memberships, and outreach to Macao and the Greater Bay Area via career fairs and university talks, ensuring a robust talent pipeline for the dynamic banking industry.

Embracing technology and digitalisation

In 2025, HKIB’s digital transformation journey continued as it embraced technology to elevate both the learning experience and operations. Beyond upgrading core functions through MyHKIB for enhanced CRM capabilities, HKIB has introduced a data warehouse to centralise and analyse information, improving data quality and insights. We have also implemented a Learning Management System (LMS) to provide seamless access to interactive learning resources, alongside a Digital Credential initiative (DCS) that offers a secure, web-enabled version of professional qualifications.

Building on the established LMS, in 2026, we will integrate a next-generation learning platform that delivers a flexible, blended experience. This approach combines self-paced digital modules focused on practical knowledge with interactive, trainer-led sessions that encourage experience sharing and discussion, enabling Members to learn anytime, anywhere.

Following its launch, the DCS will continue to support newly qualified professionals into 2026 and introduce an additional feature for employer verification, strengthening transparency and trust in credentials and delivering greater value to both banking professionals and employers alike. In 2026, the main priority will be enhancement updates to further optimise the platform.

Additionally, HKIB will deploy agentic AI to automate processes such as reconciliation reporting, improving efficiency and accuracy, reducing manual workload and enabling staff to focus on activities that support strategic growth. This initiative reflects our commitment to leveraging advanced technologies to streamline operations and support strategic growth.

Looking ahead

Reflecting on 2025 as a year of transformative innovation, 2026 is a time of purposeful progress, turning strategy into action, expanding HKIB’s reach and nurturing the next generation of banking professionals. In this spirit, I call for continued collaboration across the industry.

In this journey forward, Hong Kong’s leadership in Fintech and financial events, exemplified by flagship gatherings like the Asian Financial Forum and Hong Kong FinTech Week, underscores the city’s connectivity and global draw. Events like these thrive on collective effort, a priority HKIB continues to nurture. As we enter the year, I would like to take this opportunity to extend my heartfelt thanks to the supporting banks, partners, stakeholders, and my colleagues for their unwavering trust and partnership. Together, we will shape a competent, ethical, and future-ready banking industry.

Carrie LEUNG

Chief Executive Officer